When should your agency recognise revenue?

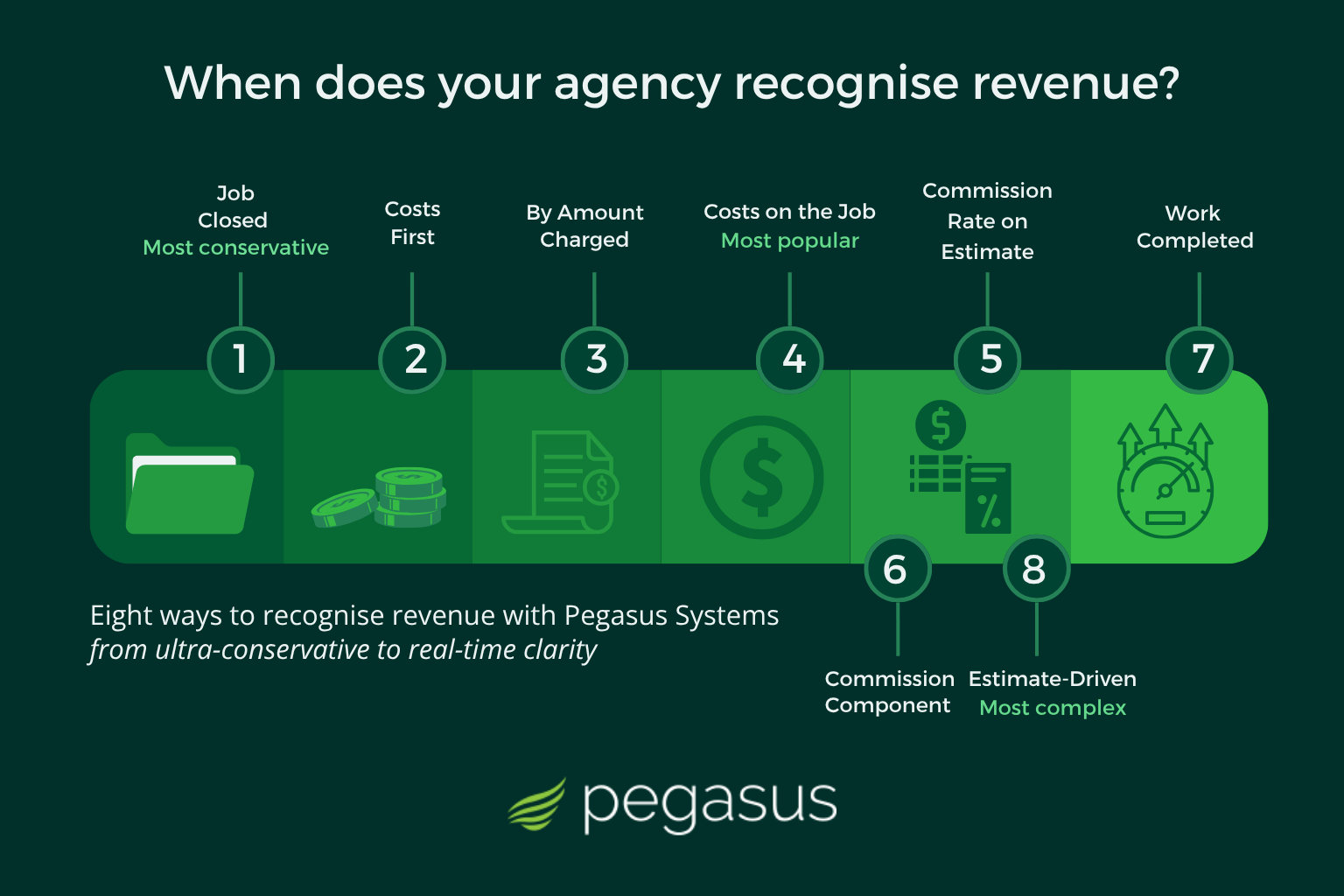

Revenue recognition is all about timing. Pegasus gives creative and full-service agencies eight models for production jobs, from ultra-conservative to real-time visibility. Add in extras like revenue adjustments, profit registers, and automatic wash-ups, and you’ve got a system that keeps your numbers clean, your accountants happy, and your agency in control.

Why Revenue Recognition Matters

For agencies, revenue isn’t just “money in, money earned.” The key question is: when should that revenue show up in your accounts?

Get it wrong, and you risk:

Overstating income before work is complete.

Understating income and missing the big picture.

Frustrating your accountants (and auditors).

Falling foul of governance or network requirements.

Get it right, and you’ll:

See true profitability in real time.

Forecast and manage cash flow with confidence.

Keep your reporting aligned with compliance rules.

Build trust in the numbers across your leadership team.

Pegasus builds this straight into the system with eight recognition models to fit different needs and appetites for risk.

The 8 Revenue Recognition Models for Agencies

These models apply to Production jobs, making them especially useful for creative agencies or full-service agencies managing production or internal billings.

Importantly, these models control when revenue is taken up. Pegasus also has a separate setting that controls how revenue is recognised, either by Cost Centre or by Job Type, which determines what P&L accounts the numbers hit. That’s another layer of flexibility, but in this blog, we’re focused on the when.

Here’s the simplified, human-readable version:

Only When It’s Over (Most Risk-Averse)

Revenue is only recognised when the job is closed. Until then, progress billings sit in prebill.Costs First

Revenue is recognised as job costs are charged. If there are no costs, billings stay in prebill.By Amount Charged

Revenue is recognised on the amounts charged. Overcharges are taken as revenue.Costs on the Job (Most Popular)

Revenue is recognised as job costs are charged. Overcharges from external centres sit in prebill, while internal charges are always taken as revenue.Commission Rate on Estimate

Revenue on externals is calculated using the cost centre commission rate, with internal charges always taken as revenue.Commission Component

Similar to #5, but changes the WIP and prebill component of external charges on an estimate.Profit Recognition (Work Completed)

Revenue is tied to job costs, with both internal and external overcharges posted to prebill.Estimate-Driven (Most Complex)

Similar to #5 and #6, but uses cost and charge values on the estimate to calculate and post revenue.

These are top-line explanations. The Pegasus team can unpack the details and help you choose the best fit for your agency.

More Than Just Models

Picking a revenue recognition model is your default, but Pegasus doesn’t stop there.

Revenue Adjustments: Fine-tuning recognition

Your chosen revenue recognition model sets the default for how revenue is taken up when you raise an invoice on a job. But what if you need to fine-tune it? Pegasus lets you make revenue adjustments, either when you create the invoice or later, so you can tailor recognition to exactly what’s right for that job at that time.Profit Register at Invoicing

See exactly what Pegasus will calculate as billings, revenue, WIP and prebill before the invoice goes out.Full Transparency

At any time, you can check what’s billed, what’s recognised as revenue, and what’s sitting in WIP or prebill, both on screen and in reports.Automatic Wash-Up on Job Closure

Close a job, and Pegasus tidies everything up, clearing WIP and prebill. (Pegasus does the washing up for you.)Governance Confidence

Agencies tied to legal, governance or network rules (e.g. % completion) can configure Pegasus to stay compliant without extra spreadsheets.Separate Streams for Internals vs Externals

All recognition models (other than #1 and #3) treat internals (head hours) and externals (supplier costs) differently, so you’ve always got clarity and control over both streams of data.

Which Option Suits Your Agency?

Risk-averse? Go with #1.

Want real-time visibility? Most agencies pick #4.

Looking for balance? #2 and #5 are favourites.

The bonus? Except for #1 and #3, every option treats internals (head hours) and externals (supplier costs) differently, so you get granular control over both streams.

Why Pegasus is the Best Choice for Revenue Recognition in Agencies?

Eight built-in models (no spreadsheets or hacks required)

Handles complex production billing with ease

Reduces compliance risk and human error

Finance and client service teams finally trust the same reports

Bridges the gap between job management and financials

Your accountants will thank you.

Your leadership team will finally trust the numbers.

And your agency can make decisions with clarity.

Quick Q&A

Q: What’s the most conservative way to recognise revenue?

A: Option #1. Only when a job is closed. This is the most risk-averse approach because all uncertainties, such as delays, scope changes, or disputes, are resolved upon completion. It ensures revenue is only taken once deliverables are met, costs are final, and payment is secure, avoiding overstatement or reversals.

Q: What’s the most popular?

A: Option #4, followed closely by #2 and #5. Option #4 is favoured because it balances recognition with caution. All internal effort (e.g. head hours) is recognised as revenue as it occurs, while external costs are pushed to WIP and prebill. Once the job closes, any remaining revenue from externals is reconciled. This approach gives timely visibility of internal value delivered while deferring the riskier external elements until the job is finalised.

Q: Can my agency change models later?

A: Technically yes, but it can be tricky, especially depending on which option you’re moving from and to. It’s not an overnight switch. The good news? Pegasus will support you through the journey if your agency’s needs evolve.

Q: What happens when I close a job?

A: Pegasus automatically does a full wash-up, clearing WIP and prebill so your accounts stay clean. No messy leftovers with the system tying everything off neatly.

Q: Can I see what’s billed, recognised, or still in WIP/prebill at any time?

A: Absolutely. Pegasus shows you the live breakdown on screen and in reports, so you always know what’s billed, what’s revenue, and what’s waiting in WIP or prebill.

Q: Do these models apply to all jobs?

A: These models apply to all invoices billed under jobs in the Production module. Invoicing done through manual invoices, standing charges (like retainers or fees), and media billing use different configuration settings for how revenue is recognised.

Q: Why does timing matter for compliance?

A: Some networks and ownership structures require revenue to be recognised in specific ways (e.g. % completion). Pegasus helps you stay onside without extra workarounds.

Q: What about internals vs externals?

A: All options (except #1 and #3) treat internals (head hours) and externals (supplier costs) differently. That way, you’ve got control over both streams of data instead of lumping them together.

Q: What is the profit register, and why does it matter?

A: At invoicing, Pegasus gives you a “profit register”. A clear preview of billings, revenue, WIP and prebill before you finalise the invoice. Not only can you see it for each invoice, but also as a total for the job (including prior invoices) and for batch totals (all jobs or invoices being raised). You can view it by summary (internals, externals, and total) or detailed (by cost centre). No surprises, just full transparency.

Ready to Recognise Revenue the Smart Way?

Stop bending your reporting around outdated systems or spreadsheets. With Pegasus, revenue recognition finally fits your agency, not the other way around.

👉 Serious about clarity and compliance? Book a demo with Pegasus Systems today.